Corporate

Make informed decisions about potential corporate borrowers or the entities you have invested in. See the customer and supplier concentration, operating and financing cashflows, and much more. All data is fully interactive and searchable.

Make informed decisions about potential corporate borrowers or the entities you have invested in. See the customer and supplier concentration, operating and financing cashflows, and much more. All data is fully interactive and searchable.

Make informed decisions about potential individual borrowers in record speed. Understand the potential borrower behaviors and assess their creditworthiness. All data is fully interactive and searchable - easily spot any potentially risky behaviors.

Cut down on data acquisition and analysis expenses. Enjoy fair pricing, user-friendly solutions, and exceptional assistance. Get started without any initial investment.

Get easy access to accurate and reliable information that is free of human error. Ability to easily analyze bank statements of multiple different banks.

Gain a competitive edge by providing unprecedented speed in reliable bank statement analysis. Ensure unbeatable user experience for your team and customers every day.

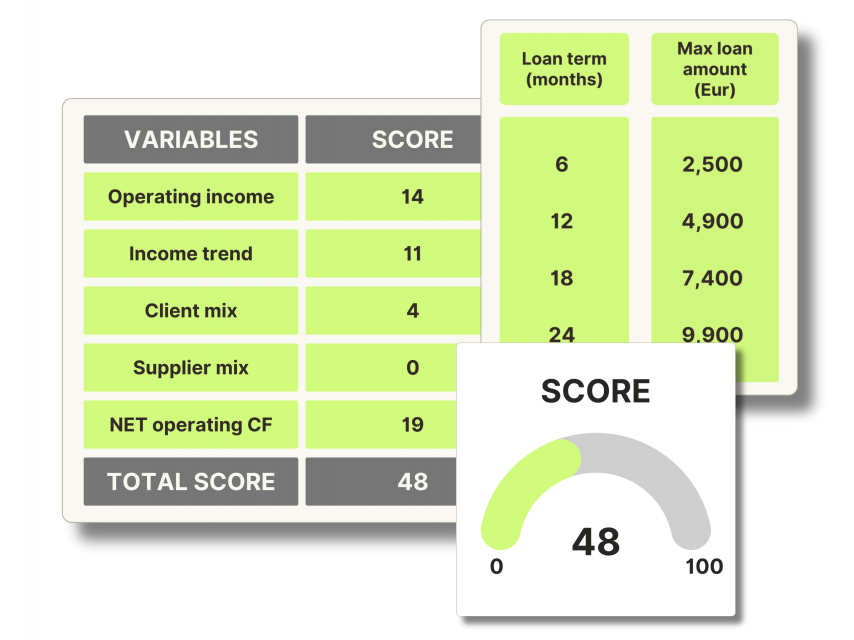

Streamline and automate evaluation of borrower creditworthiness. Systematically, both the maximum loan size and the borrower's level of credibility are determined.

Win customers and increase your profitability by increasing the speed at which you respond to potential borrowers with loan offers and by reducing the number of false rejections.

The scoring model can be adapted to your specific needs or based on the rich experience of our team. Let’s talk and find the best solution that meets your specific needs.

Use our interactive features to search, filter for the specific transactions you need to make the best financing decisions for individual or corporate users.

We understand your users bank internationally. Softloans enables your users to connect accounts from countries all around Europe and the UK (2500+ banks in 30+ countries*).

Access historic data refreshed daily for precise decision making. That can be a lot of data, but our filter and search functions make it easy for you.

The calculations of credit limits are dynamic as the user can modify the values of key variables, such as the level of interest rate or future growth rate.

Seeing is believing. Test our solution with up to 10 customers per country completely free of charge. We know you will enjoy the experience.

Unlimited number of customers.

One time set-up fee.

A set price per requisition a month.

No fixed expenses.

We understand there is no one size fits all. Contact us to work out a solution that serves your needs the best.